Investing in alternatives

Should advisers turn to alternative assets to balance and diversify their portfolio?

As the coronavirus crisis goes on, debate continues about where stocks are heading.

Adrian Lowcock head of personal investing at Willis Owen says markets have sold off and rallied again during the lockdown phase, and adds we are only at the end of the beginning.

Additionally, the crisis is likely to have lingering effects initially on company profits, bond yields and interest rates offered on cash but also longer-term it will affect inflation and economic growth.

While some advisers may have increased their exposure to some alternative assets amid the Covid-19 crisis, others avoid them because they believe the performance of such investments are not consistent enough.

So a key question is whether alternative assets can form part of a balanced portfolio?

Are they really diversified and can they perform well in the present turbulent market conditions?

Advisers unlikely to turn to alternatives

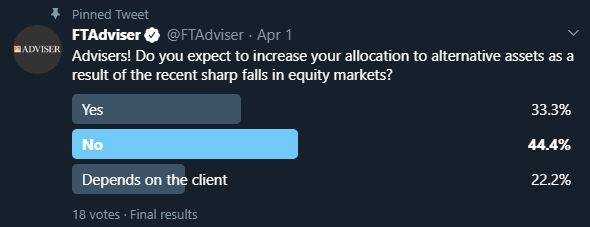

Advisers are reluctant to increase their exposure to alternative investments in the current market conditions, according to an FTAdviser Talking Point poll.

The poll asked: “Do you expect to increase your allocation to alternative assets as a result of the recent sharp falls in equity markets?”

The data shows advisers generally resistant to this idea, with 44 per cent not likely to increase their allocation, compared with a third who intend to do so.

With fixed income unattractive we believe alternatives have an important role to play in diversified portfolios.

Alternative assets covers a wide range of products, ranging from absolute return funds and gold, to niche property funds such as those that invest in student property and healthcare centres.

Bill Dinning, chief investment officer at Waverton is “neutral” on equities, that is, he has the same weight in portfolios as the market as a whole, but keen on alternative assets as an alternative to the bond allocation he typically places in portfolios.

He said: “With fixed income unattractive we believe alternatives have an important role to play in diversified portfolios.

"That role is two fold: first, Absolute Return strategies can give exposure to an uncorrelated stream of returns giving diversification benefits.

"This sector has struggled in recent years but well-run funds have attractive volatility dampening characteristics.

Income return

"Second, real assets such as property (both physical and intellectual), infrastructure (including transportation), commodities (such as gold) and other investments underpinned by physical assets offer a combination of income and capital return that is attractive.

"Many of the assets that produce income have inflation-linked cashflows.”

James Sullivan, multi-asset fund manager at Miton Optimal, said he tends to avoid most alternatives other than gold, as he believes the performance of such investments is “not consistent enough".

Role of alternatives in a balanced portfolio

Words: David Thorpe

Images: Fotoware

A feature of the decade long bull market that ran from the end of the global financial crisis to the start of the Covid-19 emergency was a rise in the proliferation and popularity of products that invest in assets other than bonds and cash.

The first wave of these mandates included absolute return funds, which promised a “positive return in all market conditions”.

The popularity of these strategies was such that one of the pioneers of such strategies, the Standard Life Global Absolute Return (Gars) fund became the largest retail fund in the UK market.

But the assets held in such funds have dwindled in recent years alongside the performance.

The average fund in the Investment Association (IA) Total Return sector has lost money over the past five years.

Mixed reviews

Francis Klonowski, an adviser at Klonowski and Co in Leeds, says he has never used absolute return funds as he finds the promise made by many such products to deliver positive returns in all market conditions, “not realistic”.

The sharp dip in global markets owing to the Covid-19 pandemic was the first real test for many absolute return strategies, and many failed to cut the mustard.

Bill Dinning, chief investment officer at Waverton, is much keener on such funds.

He says that while the sector as a whole has struggled in recent years, the better funds in the sector have delivered returns that are not correlated with the wider market.

Data compiled by the Interactive Investor platform found that only nine of the 118 Absolute Return funds in the UK market delivered a positive return during the sharp Covid-19 inspired sell-off in March.

Absolute vs Equity

But the research did note that two thirds of the funds in the sector kept the losses below 10 per cent, meaning that they generally performed better than equity markets.

Dmitri Lipsky, head of fund research at Interactive Investor says: “The sharp dip in global markets owing to the Covid-19 pandemic was the first real test for many absolute return strategies, and many failed to cut the mustard.

"The absolute return label is somewhat of a misnomer as many funds in the sector fail to deliver convincing returns in any market conditions.

"However, they should, in theory, lose much less than strategies with a similar risk level and most appear to achieve this during the recent market sell-off, albeit over a very short space of time.”

Alternatives strategy

Mike Coop, fund manager at Morningstar says the first task when assessing the role of alternatives in a portfolio, is to divide the asset class into two; with liquid assets in one pile and illiquids in another.

He adds: “What has been happening in recent years is that asset allocators generally have a debt part of a portfolio, and an equity part, and because bond prices have generally been quite high, they have allocated more to alternatives and less to debt.

The absolute return label is somewhat of a misnomer as many funds in the sector fail to deliver convincing returns in any market conditions

"The first thing to understand about that is if you are reducing debt and increasing alternatives you are almost certainly taking more risk.”

“If you are buying the more liquid alternatives, then you are really getting exposure either to an equity investment, which is a share of the future cashflows, or a debt investment in another way, so you have to ask really whether you are getting something that will be a real offset if equities fall?”

A danger with the less liquid investments is that because they do not price daily, it can look as though they have performed well, and the losses only become apparent later.

Balancing act

Adrian Lowcock, head of personal investing at Willis Owen says that alternatives should play an important role in any balanced portfolio.

Once through the crisis I think the data will show that alternatives protected investors and behaved differently to both equities and bonds even if there were short periods of correlation.

Mr Lowcock adds: "This is a diverse asset class and includes everything from gold to absolute return funds to specialist equities.

"The issue for the asset class is that in times of crisis anything that is an equity, alternative or not will get caught up in a general sell-off of shares as we have seen.”

Less liquid alternative investments include student property, aircraft leasing and doctors surgeries and infrastructure funds.

Mr Lowcock finds this area, which might be termed alternative income, all together more interesting.

He says: “One of the other benefits has been the differentiated income stream and here the picture is currently less clear. The crisis has wiped GDP out for a quarter and is resulting in huge dividend cuts for many companies.

"Infrastructure businesses which depend on income from the government should fare better than other sectors, but in the short term they may just err on the side of caution.

"Although given the income is a big part of investing in real assets I wouldn’t expect this decision to be taken lightly.

"Once through the crisis I think the data will show that alternatives protected investors and behaved differently to both equities and bonds even if there were short periods of correlation.”

Diversification

Nick Watson, a multi-asset investor at Janus Henderson, is also keen on alternative income assets.

He says many such mandates “are genuinely diversified” and cited renewable energy and other infrastructure funds as examples.

Additionally, the income is usually coming directly or indirectly from the government, and the payments are linked to inflation.

I can understand why alternatives do exist, and they have a role to play, but the lack of performance consistency often means the chances of selecting one that achieves its objective on a consistent basis is troublesome

David Scott, an adviser at Andrews Gwynne says: "Capital appreciation is likely to be very hard to come by from investments in the years ahead, so it is likely that secure income will be the only game in town.

"I like infrastructure funds for this, because the income is backed by the government the same as government bonds are, but the yields tend to be higher and goes up in line with inflation.

"I was quite surprised to see infrastructure funds sell off in March. but they have recovered since, and I think other sources of secure income are eye-wateringly expensive."

Inconsistent performance

James Sullivan, UK managing director at Miton Optimal is more skeptical, as he finds the performance of alternative assets “too inconsistent” to be a reliable asset allocation option.

“I can understand why alternatives do exist, and they have a role to play, but the lack of performance consistency often means the chances of selecting one that achieves its objective on a consistent basis is troublesome," Mr Sullivan says.

You have to be very careful with structured products to understand what is behind them.

Structured products

An option favoured by Ian Lowes, managing director of Lowes Financial Management, an advice firm in Newcastle, is that structured products have a place in a clients portfolio.

He says: “I like structured products in any market conditions. I know I can't predict what happens next but obviously at times like these, both the protection and the upside achievable on a small recovery, make them exceptionally appealing.

"Structured product funds suffered in the downfall along with most equity-linked funds and while they bounced quite well, because all of the trades under the bonnet have defined outcomes in different market circumstances, we believe they represent an excellent recovery play.”

Mr Scott adds: “You have to be very careful with structured products to understand what is behind them, what is underwriting them, because if that is wrong, then it could be nasty and all of the investment would be lost.”

Gold

Gold is an asset class that provokes much debate among investors.

Its role in portfolios varies sharply depending on the investor.

Many, including Mr Scott, view gold as a hedge against sharply rising inflation.

This is because, as there is a finite amount of gold in the world ( as opposed to a currency where more can be created), the gold has more chance of holding its value.

Suhal Shaikh, chief investment officer at Fulcrum Asset Management says he invests in gold by investing in the gold producers.

He adds: “We don’t expect inflation to rise sharply from here, but we think it is possible.

"The problem with owning government bonds is that we are probably not far from the point of no return for the asset class now.

Investments in alternatives such as real assets can be used as a relatively good long term inflation hedge

"And so gold is the replacement in the portfolio. We own very little in the way of bonds, and while the traditional asset allocation metric might be 60 per cent equities, we have only 30 per cent in conventional equities.

"One of the problems with investing in gold bullion is that it pays no income, but if you invest in the income stream of the companies, you get that yield as well.”

High inflation

Alexander Chartres, investment director at Ruffer, says if high inflation does become a feature of the investment landscape in the years ahead, then the likely outcome would be that both bonds and equities would fall in value, and gold would rise.

Mr Coop said he does not expect inflation to rise in the years ahead, because while there are significant inflationary pressures in the system, technological change is very deflationary and likely to keep a lid on how high inflation can rise.

According to Mr Dinning, one of the reasons investors sometimes prefer cash to gold is that there is an interest rate paid on cash, and not on gold.

In practice, that means for gold to perform better than cash, it must go up in value by more than the amount of all of the interest payments made on the cash or government bond holdings. This is known as the opportunity cost.

With interest rates and bond yields at record lows, Mr Dinning believes there has never been a time in history when the opportunity cost of owning gold has been lower.

Tony Dalwood, chief executive at Gresham House, is keen on alternative assets as a way to protect against inflation.

He says: “Investments in alternatives such as real assets can be used as a relatively good long term inflation hedge.

"They can be an effective way to protect portfolios and generate long-term, sustainable returns."

Forestry for example is an attractive asset class because it has had the most positive correlation to inflation, of more than 50 per cent over the long term, helping to protect real returns in addition to its diversifying characteristics on investment portfolios.

Housing is another asset class positively linked to inflation, as social housing and real estate can be used to generate income from rent as the value of properties increase as inflation rises.

This can help to deliver long-term cash flow and are investments that deliver a positive impact.”

How liquid alternatives could protect your portfolio during market downturns

As investors seek ways to protect themselves from drawdown risk, could liquid alternatives be the answer?

Six months on from the first known case, the effects of Covid-19 are only starting to come under control.

Nevertheless, as we are beginning to understand the scale of impact that Covid-19 has had on our society, the true economic cost remains uncertain.

Despite this, we have seen some indication of its potential magnitude.

Following the longest bull run in history, markets sold off aggressively, with the S&P 500 taking only 22 days to transition into a bear market – the fastest since records began.

Although prices have rebounded to some extent, earnings remain low, as businesses continue to get to grips with the recent demand shock, resulting in valuations remaining high and creating room for further detractions.

At this stage, markets are struggling to understand the longer-term consequences of this pandemic.

However, with many businesses being closed for an extended period of time, combined with the recent geopolitical tensions surrounding China and OPEC , one certainty is that there are going to be significant challenges for investors in the future who seek to minimise potential drawdown risk and maximise the risk/return profile of their portfolios.

As assets become more correlated with each other, investors find it ever more difficult to find assets that could adequately offer the appropriate cushion of protection against market downturns.

Drawdown risk, defined here as the largest peak-to-valley loss over a given period of time, has been an historic challenge to most investors.

As assets become more correlated with each other, investors find it ever more difficult to find assets that could adequately offer the appropriate cushion of protection against market downturns.

Nevertheless, one group of funds that have historically proven their value during periods of significant drawdown risk are hedge funds.

Hedge fund opportunities

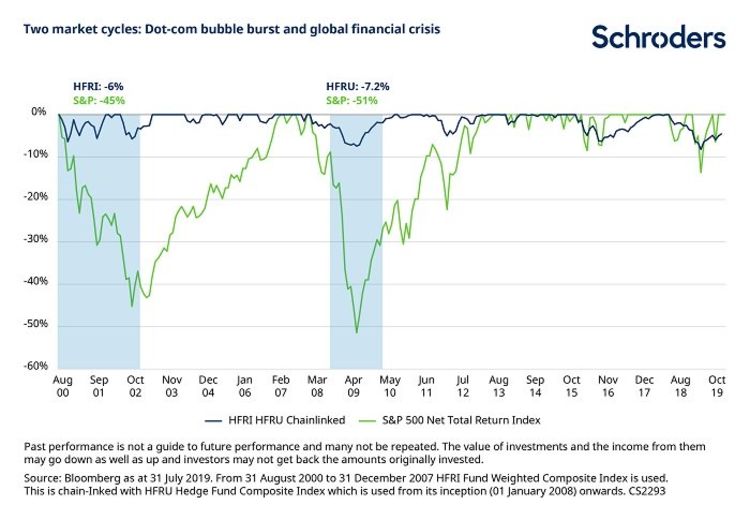

The chart below highlights this.

It shows the largest drawdowns in both the S&P 500 and the HFRU index (an equal-weighted index of over 1,400 hedge funds) since 2000.

This captures three economic cycles and subsequently three periods of major drawdown – the Dot-com bubble burst, the global financial crisis and the current Covid-19 crisis.

During the three market downturns, both the frequency and magnitude of drawdowns have been significantly less for the HFRU index, when compared with the S&P.

During the Dot-com bubble burst, the S&P’s peak drawdown reached -45 per cent, while the HFRU’s peak drawdown was -6 per cent.

Liquid alternatives can provide access to hedge fund strategies through a regulated product structure.

Similarly, during the financial crisis, the HFRU’s peak drawdown was only -7.2 per cent, while the S&P peaked at -51 per cent.

Today, that pattern continues, with the HFRU falling only 10 per cent, whilst the S&P peaked at -20 per cent.

Taking this into consideration, it becomes apparent that hedge funds can provide an adequate cushion against drawdown risk during market downturns, potentially proving to be an important asset for providing protection to investor portfolios.

Liquid alternatives can provide access to hedge fund strategies through a regulated product structure.

By utilising liquid alternatives, an investor could find themselves in a better position to navigate through challenging periods of tail risk and, therefore, strive towards achieving the appropriate risk/ return profile that suits their needs.

Darnell Conteh is a product executive